Why Join the WSCPA?

Welcome to your professional community!

The Washington Society of CPAs is a professional community of CPAs and financial professionals who work in business and industry, education, government, not-for-profit organizations, and public accounting. With more than 6,500 members, the WSCPA is the only organization in the State of Washington dedicated to serving the professional needs of CPAs, educating consumers about CPAs and the services they provide, and encouraging students to study accounting and enter the profession. WSCPA members are CPAs and financial professionals, students, and retirees.

Ask your employer to support your WSCPA membership - Download Sample Letter

Member Benefits

From continuing professional education to networking, the WSCPA offers the services and programs that you need as a CPA in Washington. When you join the WSCPA, you receive valuable discounts, services, benefits and opportunities to advance and enhance your career. These discounts more than pay for your membership.

How Much is Membership?

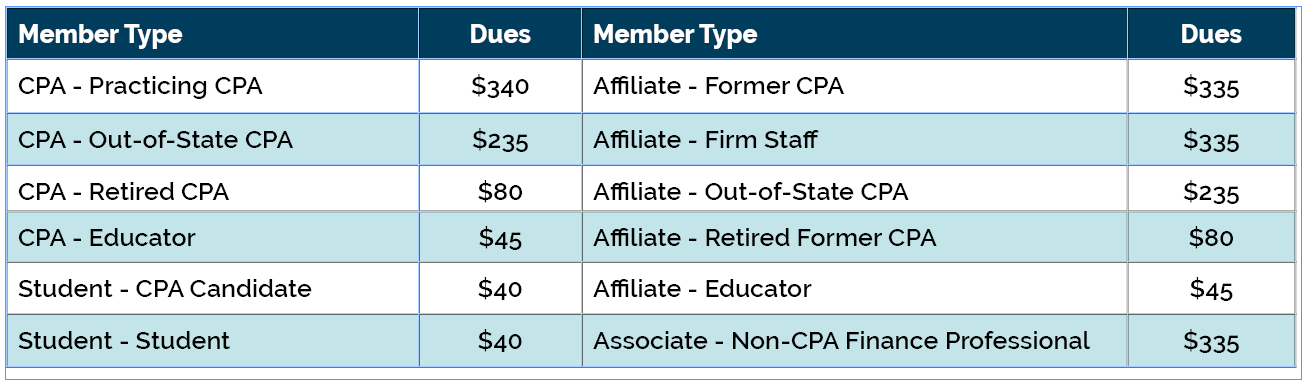

Membership dues are based on the WSCPA's fiscal year, which runs from June 1 to May 31 each year. Dues are prorated based on the time of the year you join and your dues class.

Membership Types

- CPA – Practicing CPA: CPAs licensed in Washington or CPA-Inactive certificate holders

- CPA – Out-of-State CPA: Living AND working outside Washington

- CPA – Retired CPA: Age 65+ and retired or working < 20 hours per month

- CPA – Educator: Teaching accounting full time at an accredited college or university in Washington

- Affiliate – Former CPA: Former CPA, Chartered Accounting or Chartered Professional Accountant

- Affiliate – Firm Staff: Non-CPA professional staff working in CPA firm

- Affiliate – Out-of-State: Former CPA, Chartered Accountant, or Chartered Professional Accountant living AND working outside Washington

- Affiliate – Retired Former CPA: Former CPA age 65+ and retired or working < 20 hours per month

- Affiliate – Educator: Non-CPA teaching accounting at an accredited college or university in Washington

- Associate – Non-CPA Finance Professional: Non-CPA accounting or finance professional who is sponsored by a WSCPA regular CPA member

- Student – CPA Candidate: Graduated from college or applied to sit in the 6-month exam window while still in college, and actively working towards CPA licensure

- Student – Student: Accounting student at an accredited college or university and plan to sit for the Uniform CPA exam when eligible

Disclosures - Payment of membership dues is deductible for most members of a trade association under Section 162 of the Internal Revenue Code as an ordinary and necessary business expense. However, WSCPA estimates that 7.81% of the dues payment is not deductible as a business expense because of WSCPA lobbying activities on behalf of its members. Contributions to CPAPAC are not deductible as charitable contributions for federal income tax purposes. Contributions to the Washington CPA Foundation are deductible as a charitable expense.