Why More Employees Aren't the Answer: Focusing on Your Best Clients

November 18, 2024

by Matthew F. Hersch, CFP®, CEPA

The shortage of available accountants can make expanding your team difficult and risky, leading to increased complexity and potential cultural issues. A more strategic approach involves segmenting your clients to focus on high-value relationships and reassessing your minimum fees to better balance supply and demand.

If you were able to transform your business in a way that would help you transform your life, what would that give you? More money, more time off, and less stress often make the shortlist. The pursuit of these goals is common, yet elusive for many business owners. The primary barrier? Time.

When we think of solutions, hiring more people frequently comes to mind. However, a shortage of qualified accountants makes this approach challenging. Even if you were to find someone, hiring often addresses the wrong problem—catering to clients who no longer align with your practice instead of adding value to your best clients. We often think about the salary when hiring, but there are other issues to contend with as well that shouldn't be overlooked: the hidden costs of hiring (bonuses, 401(k) match, health care benefits, workstations, etc.), the complexities of managing more employees, and the impact on your firm’s culture if a wrong hire is made.

Additionally, it is important to think about who you work with and how. This can be thought about from two different angles. First, identify the clients you are working with and how you are helping them. Second, who are you working with at your firm and how are they working to create a better client experience? To start, let's walk through a way to assess your client base to understand the various categories of clients and the potential opportunities with each.

Segmenting Your Client Base Differently

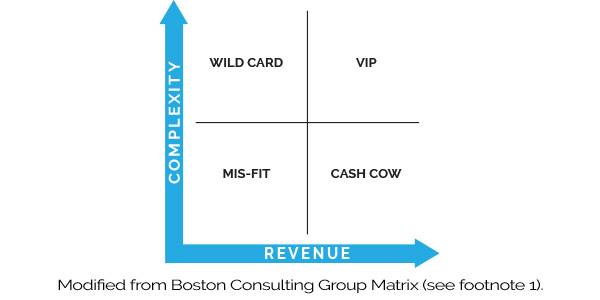

You’ve likely encountered the Boston Consulting Group Matrix(1) (think of the Cash Cow) for client categorization. While useful, our experience led us to modify this matrix to better serve the needs of a professional services organization. On the x-axis is revenue (high on the right and low on the left). On the y-axis is complexity (high on the top and low on the bottom).

Quadrant 1: VIPs (High Revenue, High Complexity)

Not only do these clients generate high revenue, but they also have complex and evolving situations. There are numerous advanced planning opportunities with which to assist these clients and monitor over time. Addressing these needs requires both subject matter expertise and ongoing communication with the clients and their teams of professionals.

Who should work with this group? We see the firm's partners working best with these clients. Not only do the partners typically have the most experience, but they also have the closest relationships to these clients.

Quadrant 2: Wildcards (Low Revenue, High Complexity)

At first you may be scratching your head on this one. Wildcards may not yet generate high revenue but have the complexity and potential to become VIPs. These are clients who are on the verge of a change in their situation, which will require a more in-depth engagement with the firm over time.

Who should work with this group? We often see people on the track to becoming a partner working with this group of clients, as they too may be viewed as wildcards and can grow alongside the client and their situation.

Quadrant 3: Cash Cows (High Revenue, Low Complexity)

This is the only quadrant name retained from the original matrix. These clients meet a revenue threshold above your minimum fee, prefer working with a professional to going it alone, yet have straightforward situations, making them less likely to need advanced planning.

Who should work with this group? We feel that this quadrant can be overseen by a relationship manager that has the experience and people skills to manage a larger number of clients who simply need the job to be done and done right.

Quadrant 4: Mis-Fits (Low Revenue, Low Complexity)

Mis-Fits are clients who have become misaligned with the work your practice does and therefore are no longer the right fit as clients of your firm. People often discount the impact that this group has on the firm, but this group often collectively can require a disproportionate amount of the firm’s resources relative to the revenue they produce.

Who should work with this group? Ideally, someone that is outside of your firm. While there will always be people in this group that will remain in your practice, it is likely that there are also a number that can be transitioned to a new home outside of your firm.

Then What?

Once you’ve categorized your clients, the next steps are crucial for optimizing your practice.

Step 1: Assess Your Teams' Capabilities

Evaluate your team members, determining who has the skills to manage the relationships in the various categories. Keep in mind that the people overseeing each category may have different strengths. Only once you turn over the management of these relationships will you have the needed bandwidth to work more closely with your VIPs.

Step 2: Review Mis-Fits

Identify which Mis-Fits are in fact misaligned and no longer fit your practice. Once identified, develop a strategy to transition them to a new home that is better suited for their needs. For those that do remain, ensure the fee they are paying at a minimum covers the cost of having them as a client.

Step 3: Focus on VIPs

We have all heard of the 80/20 rule and it wouldn't surprise me if 80% of your revenue comes from the top 20% of your clients. Spend the majority of your time as a partner with these people, who are likely your VIPs. Seek out additional planning opportunities and work closely with them and their team of professionals to implement these strategies. Not only will this help you have a lasting impact on these clients’ lives, but it will likely lead to introductions to more people just like them.

Effectively segmenting your clients and focusing your time on those who provide the most value can be transformative to your business and the lives of your clients. While this transformation will likely have an impact on your professional life, it will also give you the personal benefits you seek—more money, more time off, and less stress. Embrace this strategy to achieve the balance you desire while making a true impact on the lives of your best clients.

Matthew F. Hersch, CFP®, CEPA, is Executive Director and Financial Advisor of Pike Place Partners at Morgan Stanley. You can contact Matthew by email.

This article appears in the fall 2024 issue of the Washington CPA magazine. Read more here.

Matthew Hersch is a Financial Advisor with the Global Wealth Management Division of Morgan Stanley in Seattle, Washington. The information contained in this article is not a solicitation to purchase or sell investments. Any information presented is general in nature and not intended to provide individually tailored investment advice. The strategies and/or investments referenced may not be appropriate for all investors as the appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Investing involves risks and there is always the potential of losing money when you invest. The views expressed herein are those of the author and may not necessarily reflect the views of Morgan Stanley Smith Barney LLC, Member SIPC, or its affiliates. Information contained herein has been obtained from sources considered to be reliable, but we do not guarantee their accuracy or completeness.

CRC 3822359 09/24

Learn More

Hear Matthew Hersch at the 2024 Pacific Tax Institute, October 29-30 at Meydenbauer Center in Bellevue or by Webcast. Register now!

- Henderson, Bruce. "The Product Portfolio," BCG