WSCPA Prix Fixe CPE Series

Save big with the Prix Fixe Series!

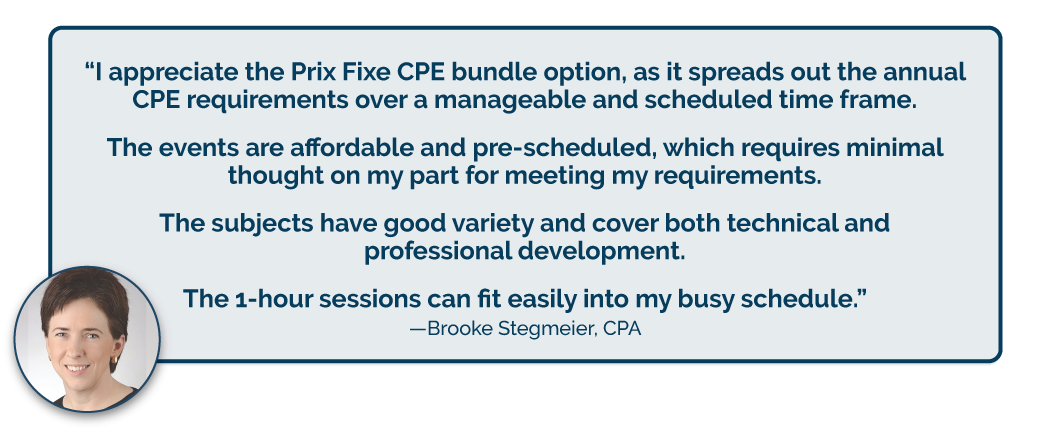

The Prix Fixe CPE Series Bundle is a collection of one-hour webinars on a variety of technical accounting topics held throughout the year (June 1, 2024-May 31, 2025). Each webinar is worth one CPE credit. They are always held on Friday at noon, so grab your lunch and tune in for a quick and informative update.

Discover how to use technology for fraud detection, how to hire fast with confidence, how to strengthen your ESG strategy, and so much more! Every Prix Fixe session is an exciting new adventure.

Our expert speakers will be your guides, providing practical advice and actionable tips to help you succeed in both your personal and professional lives. With our convenient and concise one-hour webinars, you can fit deep dives into your schedule without missing a beat and gain 30 hours of CPE over the year.

Don't miss out on this immersive learning experience that will leave you energized and equipped to tackle any challenge. Join us on Fridays at noon and prepare to explore a wide range of topics. Register now to secure your spot and elevate your career to new heights. View the year’s lineup and register for the webinars a la carte, or buy all of them and save with the Prix Fixe CPE Series Bundle!

Note: due to the unbeatable value of the Prix Fixe CPE Series, we are unable to apply additional discounts to the purchase price, nor can we offer substitutions, transfers, or refunds of any kind.

Prix Fixe CPE Series Frequently Asked Questions

Online registration for Prix Fixe CPE Series webinars closes two hours prior to the start of the specific webinar. Please call the WSCPA directly if you need to register after 10 AM on the day of a Prix Fixe CPE Series webinar.

The WSCPA CPE & Education Department will email you log in instructions three days before and one hour before the webinar. This information will be sent to the email the WSCPA has on file for you. If you do not see the email in your inbox, please check your junk folder. If you still cannot find it, please call the WSCPA at 425.644.4800.

No. Prix Fixe CPE Series webinars begin promptly at noon. If you log in late and miss the attendance prompts, you will not receive credit for the webinar. Please log in to the session at least 10 minutes prior to the scheduled start time to ensure that you are able to connect.

You will be prompted three times to verify your attendance during the presentation. In order to verify your attendance, and earn your CPE, simply click the button on the prompt that will appear. You must respond to this prompt each time it appears in order for us to issue a certificate of attendance.

Your CPE certificate will be available to download from the WSCPA website within five business days of the Prix Fixe CPE Series webinar. We will send you an email to let you know when it is available.

If you are attending a Prix Fixe CPE Series webinar as a group, be sure that all members of the group are registered by 10:00 AM on the day of the event. The WSCPA will only award CPE credit to individuals who have paid and registered for the Prix Fixe CPE Series webinar in question.

The member of the group who is signed in to view the webinar must respond to each of the three attendance prompts that will appear during the presentation by clicking on the button on the prompt. Additionally, another form of verification is required to award CPE to those attendees not directly signed in via the webinar viewing platform. For your group, produce a scan of a document with:

- The name and date of the Prix Fixe CPE Series webinar

- Printed names of those who attended with accompanying signatures

For your convenience, the WSCPA has prepared a printable sign-in sheet (PDF, 339 KB). Send a scan of the completed sign-in sheet to cpe@wscpa.org.

By purchasing the Prix Fixe CPE Series Bundle, you are registering for each Prix Fixe CPE Series webinar included in that bundle. Due to the unbeatable value of the Prix Fixe CPE Series, we are unable to apply additional discounts to the purchase price, nor can we offer substitutions, transfers, or refunds of any kind. Additionally, unattended webinars do not “roll over” into any subsequent year’s Prix Fixe CPE Series.

CPE credit for the Member Exclusive webinars will only be awarded to individuals who attend the webinar and are members in good standing of the WSCPA at the time of attendance. Prix Fixe webinars are not dependent on member status.

The WSCPA reserves the right to to make speaker and/or topic substitutions at any time of the year without notice to registrants. Should such a change occur, the WSCPA will notify registrants and update the information on the Prix Fixe CPE Series bundle event page as soon as possible.

Policies specific to the Prix Fixe CPE Series supersede all other WSCPA CPE policies and procedures including, but not limited to, cancellations, refunds, transfers, and substitutions.

For auditing purposes, your attendance may be monitored.

Still looking for the answer to your question? Check out our full CPE policies page.

The Washington Society of CPAs is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of group-live and group-internet-based continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org

For more information regarding refunds, complaints, program cancellations or other policies visit our policies page or call 425 644 4800.