by

Ashley Kittrell

| Jun 26, 2019

Engrossed Second Substitute House Bill 2158 "Creating a workforce education investment to train Washington students for Washington jobs" was passed during the 2018-19 legislative session to provide funding for higher education and workforce training. Funding for the initiative comes from increased business and occupation taxes on service-sector employers and will go into effect January 1, 2020.

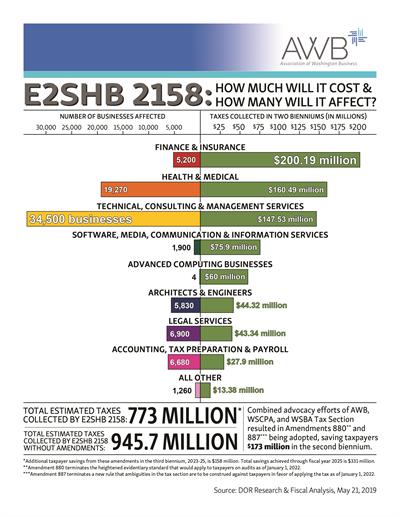

The graphic by Association of Washington Business below demonstrates the fiscal impact to businesses over the next two bienniums.

Related Resource:

Background on Engrossed Second Substitute House Bill 2158 (scroll to bottom of article)