A key statistic from the most recent Rosenburg Practice Management Survey is that 60-72 percent of partners in CPA firms are over age 50. With the aging of the accounting profession coupled with the projection that all of those in the baby boomer generation will be age 65+ by 2030, there’s no better time to support your soon-to-be-exiting leaders with a post-exit plan than now.

According to the report “The Four Pillars of the New Retirement: What a Difference a Year Makes” by Edward Jones, Age Wave, and The Harris Poll, 77 percent of those planning to retire wish there were more resources available to help them plan beyond just their finances.

Retirement is one of the biggest emotional, psychological, and mental transitions in our lives, yet little attention is given to it beyond financial and estate planning. For many whose identity is closely tied to work, it can be something to dread, creating a whole host of issues, not the least of which is going into a potential downward health spiral post-exit.

If your firm or company is one where the extent of supporting employee retirements is the annual visit by your employer-sponsored retirement plan representative to talk about investments, along with a “bon voyage” party, it may be time for a different approach to support those on the verge of retiring while also developing your rising stars.

A Matter of Identity

For some, retirement is something to look forward to as a next exciting chapter in life, or a continuation of life as they know it. For others, though, it can be viewed as a time of chaos or a long, slow march toward the inevitable end. According to the theory of role centrality, popularized by author and researcher B.J. Biddle and others, the more positive view we have of our profession upon entry, the more negative view we have of leaving it behind (high role centrality). Or, contrarily, if we’re not that closely tied to our careers when we start working, the easier our transition to retirement will be (low role centrality).

When the first words out of someone’s mouth in response to the question, “What do you do?” is about work, that’s a good sign that there’s high role centrality in play, potentially leading to a tougher time transitioning to retirement. If life has been work and work has been life, the thought of leaving the firm or company, not to mention clients, behind can strike fear in the hardiest of hearts. No wonder many leaders still come into the office when they’ve got one foot out the door, hesitant to leave completely. If not this in their lives, then what?

Benefits of Developing Retiring Leaders

Why bother investing in the career development of those who will be exiting soon? For a number of reasons, including that it:

- Creates “raving fans” of alumni who can spread the word to recruit talent for your firm or company as a “best place to work”;

- Lessens any struggle and awkwardness of the exit process;

- Lends itself to help with succession planning, younger talent development, and knowledge and client transfer;

- Allows people to exit smoothly sooner, knowing they have goals and a plan post-exit, freeing up positions, office space, resources and equipment;

- Serves as part of your staff and leadership well-being, development, or engagement programs.

This then begs the question, “How can we do this, especially if resources are limited?” By following a framework that sets you up for success.

End-to-End Talent Development Framework

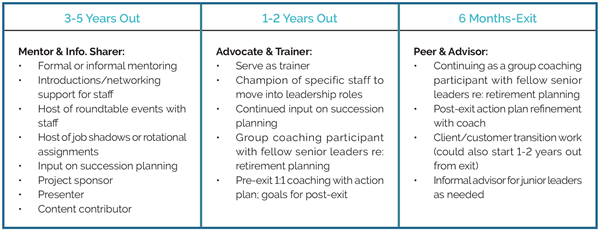

To provide a gradual “off ramp” for your exiting leaders, consider how they can wear different “hats” beginning three to five years out from their exit to in turn support the growth and career development of up-and-coming talent. These roles can be focused on mentoring and knowledge transfer, playing the role of advocate for high-potential leaders, and serving as a trainer, a peer group member with fellow older workers, and an advisor to junior staff and the organization.

The table below illustrates various potential activities and timing within this framework (click to enlarge).

Rather than having clogged talent pipelines with younger staff possibly leaving out of frustration with nowhere to go and older leaders potentially being fearful of leaving due to an anticipated loss of routine, purpose, and identity, paving the way for both groups can make life easier for all.

Notice that most of the above activities cost nothing but making time for them with a bit of structure put in place unless you choose to bring in an external coach or consultant.

Key Questions to Support Retiring Leaders

Additionally, here are a few questions you can ask yourself or pose to your team as you begin to design your strategy to support those close to exit:

- What can you provide to help them both plan for their time post-exit and remove fear of it through meaningful goals?

- How can they contribute to the firm or company pre-exit in a way that adds value and develops your talent pool?

- What information about services and life planning resources post-exit can you make available in a way that's respectful?

- What's possible in terms of a gradual exit process so it’s not as scary of a prospect for your retiring leaders?

- What's a mechanism you can put in place, if one doesn’t already exist, to know when people may exit the firm or company to inform implementing a framework?

The answers to these questions may lead to a need for research and additional leg work, though once solidified, can go a long way toward putting your organization on a path to truly being an employer of choice and an advocate for all, regardless of age, throughout the entire employee lifecycle. As humans, we don't stop learning until or unless we choose to stop or brain health issues interfere, so focusing career development efforts only until employees reach a certain level in the organization may do more harm than good in the long run, especially if the exit process is painful for all concerned.

It's critical that we support not only younger and mid-career staff, but also those who are on the verge of retiring so they can create a vision of their life in retirement, craft a “new identity” beyond their current work, and feel confident in having a plan for how they’ll spend their days, allowing them to move on as needed. It can be a small price to pay for all they’ve given throughout their careers and probably much more meaningful than the proverbial gold watch.

Lisa Downs is President of New Aspect Coaching and host of Reigniting You… with Lisa Downs, a podcast offering career transition support for professionals. You can contact her at lisa@yournewaspect.com.

Lisa Downs is President of New Aspect Coaching and host of Reigniting You… with Lisa Downs, a podcast offering career transition support for professionals. You can contact her at lisa@yournewaspect.com.

This article appears in the fall 2021 issue of the Washington CPA magazine. Read more here.