-

by

AICPA

| Feb 08, 2018

Did you receive an email from the AICPA in the evening of February 7th? Please check the email address domain and delete.

Full story

-

by

DOR

| Feb 05, 2018

On March 19, 2018, the Washington State Department of Revenue will launch My DOR as the secure portal for all online services. Access tax and business licensing accounts using your SecureAccess Washington (SAW) login. Attend a free live webinar to learn more.

Full story

-

by

Mark Hugh, CPA

| Feb 01, 2018

Recently, the Washington State Board of Accountancy revised its rules on client confidentiality to reflect the growing prevalence of CPAs and firms using cloud-based services that receive and store confidential client information. The new changes are effective February 24, 2018.

With the migration of business models to cloud services, the protection of client information has become more complex and technical.

Full story

-

by

IRS

| Feb 01, 2018

The Internal Revenue Service today reminds Alaska Native Corporations and Alaska Native Settlement Trusts that they may be able to take advantage of certain benefits in the recently enacted tax reform legislation. The new law also requires that certain contributions made by Native Corporations to Settlement Trusts in 2017 be reported to the Settlement Trusts by January 31, 2018.

Full story

-

by

Monette Anderson

| Jan 23, 2018

There are many reasons why applying for a Washington CPA Foundation Scholarship is worth your time. Here are ten facts and benefits related to winning a scholarship you may not have realized before.

Full story

-

by

Monette Anderson

| Jan 23, 2018

Being assertive is all about standing up for yourself and your needs without trampling over the needs of others. Asserting yourself and finding satisfying resolutions to office conflicts can be tricky. Read on to learn a tried-and-true method of respectfully standing up for yourself.

Full story

-

by

Ashley Kittrell

| Jan 22, 2018

WSCPA member Brett Jordan shares how being involved in WSCPA advocacy has a wide impact on his career, community, and the CPA profession.

Full story

-

by

Ashley Kittrell

| Jan 12, 2018

Get involved with WSCPA advocacy. Whether you contribute to the CPAPAC, write for All Things Advocacy, or become a Key Contact, your participation is needed and valued. Relationships need to be cultivated and your voice for the profession needs to be heard at both the state and federal level.

Full story

-

by

Anil Kshatriya, ACMA, CGMA

| Jan 12, 2018

Companies in emerging economies that are labor-intensive and technologically under-invested must give special attention to cost management. A strong culture of cost-consciousness translates into bottom-line growth, but limited resources and the presence of operational bottlenecks tend to become barriers to the progress of these enterprises.

Full story

-

by

Mark S. Brooks

| Jan 12, 2018

Employees at all levels of an organization are continuously generating new knowledge, collaborating, learning about the market and opportunities for growth, creating solutions and workarounds, and identifying stress points for both the company and its clients. Tapping into this brainpower can be a powerful force for innovation.

Full story

-

by

WSCPA

| Jan 10, 2018

Do you like crossword puzzles? The WSCPA is trying out something new in The Washington CPA - a fun section!

Full story

-

by

Alissa Wuerfel, CPA, and Anthony Sikora, CPA, KPMG LLP

| Jan 05, 2018

Data produced in the world is growing at a rapid pace. This raises a number of challenges for many businesses, including how to protect and manage that data. But it also creates a potential advantage for auditors who are able to harness technology in order to collect, transform, and analyze data while enhancing audit quality.

Full story

-

by

Kimberly Scott, CAE, WSCPA President & CEO

| Jan 05, 2018

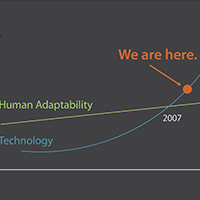

If there is one word that I seem to hear constantly, it is CHANGE. One could argue that the world around us has been in a constant state of change from the very beginning and, therefore, change is normal. However, the rate of change in technology now exceeds the rate at which we are able to adapt to change.

Full story

-

by

Khaled Abdel Ghany, PhD, CPA

| Jan 04, 2018

In March 2017, the Financial Accounting Standards Board (FASB) issued the Accounting Standards Update No. 2017-08 “Premium Amortization on Purchased Callable Debt Securities.” The requirement of this Update is to shorten the amortization period for certain callable debt securities held at a premium.

Full story

-

by

Kimberly Scott, CAE, WSCPA President & CEO

| Jan 04, 2018

Although providing scholarships to future CPAs is a key program for the Washington CPA Foundation, the Foundation Trustees are also excited to promote the profession to students that may not be aware of the opportunities a career in accounting can bring. One of the ways the Foundation does this is through providing grants to organizations with programs or events designed to improve the diversity of the CPA pipeline in Washington.

Full story

-

by

Edward R. Jenkins Jr., CPA, CGMA

| Jan 04, 2018

The Bipartisan Budget Act of 2015 (BBA) was passed Nov. 2, 2015. It was then modified by the Protecting Americans from Tax Hikes Act on Dec. 18, 2015. Those new laws substantially changed how partnerships will be audited by the IRS. The statutes took effect on Jan. 1, 2018. This article explains why Congress made the changes and what the changes to the audit regime are, identifies some traps in the new rules, and provides you with tips for compliance.

Full story

-

by

Tom G. Donaghy, CPA, WSCPA Chair for 2017-18

| Jan 04, 2018

I recently watched a video of a life-size robot jumping on and off different levels of platforms. The robot does a full flip afterwards to celebrate. Elon Musk made a comment about this video, “This is nothing. In a few years, that bot will move so fast you'll need a strobe light to see it. Sweet dreams…”

Full story

-

by

Laura Hay, CPA, CPE

| Jan 04, 2018

The implementation date for new revenue recognition requirements is rapidly approaching. What should organizations do if they find themselves underprepared?

Full story

-

by

IRS.gov

| Dec 28, 2017

The Internal Revenue Service advised tax professionals and taxpayers yesterday that pre-paying 2018 state and local real property taxes in 2017 may be tax deductible under certain circumstances.

Full story

-

by

AICPA

| Dec 21, 2017

Now that both houses of Congress have passed "The Tax Cuts and Jobs Act" bill, it's on to the oval office and the President. Find out what this means and what courses the WSCPA has in store to help you navigate this new legislation.

Full story